Maryland Cra PDF Template

The process of starting or managing a business in Maryland necessitates a thorough understanding of the Maryland Combined Registration Application (CRA) form. This comprehensive document, essential for several legal and operational purposes, guides entities through the process of registering for various state-required accounts and licenses. It specifically catisters to newly established businesses, additional locations, mergers, acquisitions, and changes in business entities, among others. By meticulously detailing all necessary information—from the Federal Employer Identification Number (FEIN) or Social Security Number (SSN) to the type of business and estimated gross wages—this form serves as the backbone for ensuring compliance with state regulations. It not only facilitates the registration for sales and use tax, unemployment insurance, and alcohol and tobacco licenses but also delves into specific details, such as the number of employees, ownership type, and business activity description. Non-profit organizations can also navigate through sections tailored to their requirements, ensuring exemption compliance and proper unemployment insurance coverage options. Furthermore, the CRA form provides a pathway to understanding the broader spectrum of responsibilities, including adherence to local laws and the necessity of obtaining various permits. In essence, the Maryland CRA form is an indispensable tool for businesses aiming for operational integrity and regulatory compliance within the state.

Maryland Cra Sample

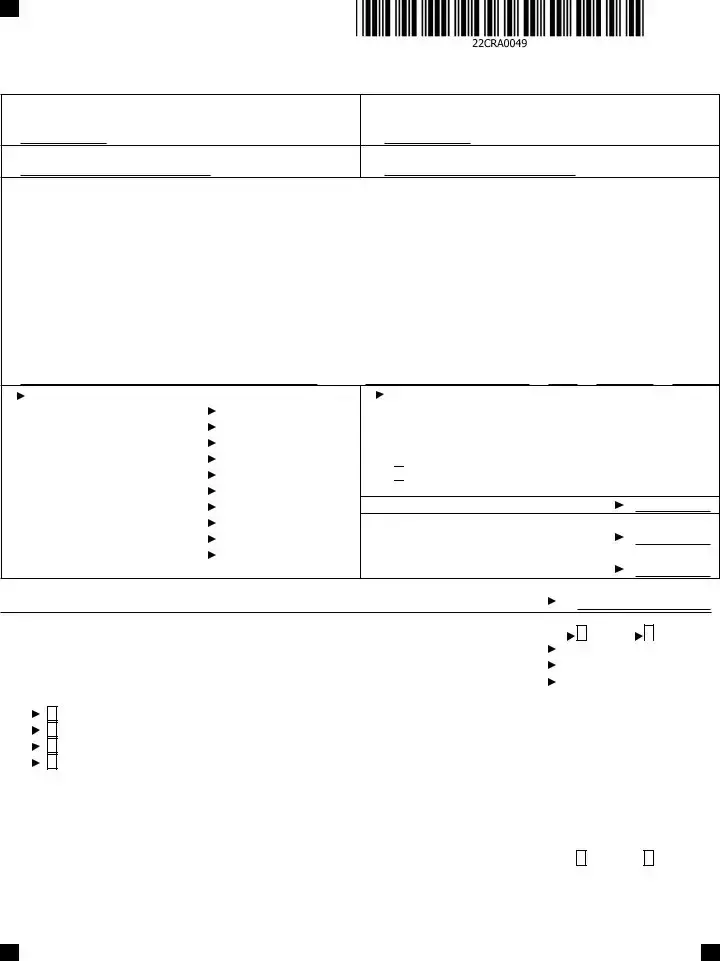

MARYLAND |

COMBINED |

2022 |

|

FORM |

|||

REGISTRATION |

|

||

CRA |

|

||

APPLICATION |

|

SECTION A: All applicants must complete this section.

1a. Federal Employer Identification Number (FEIN) (9 digits) (See instructions)

1b. Social Security Number (SSN) of owner, officer or agent responsible for taxes (Required by law)

2. Legal name of dealer, employer, corporation or owner

3. Trade name (if different from legal name of dealer, employer, corporation or owner)

4. |

Street Address of physical business location (PO Box not acceptable) |

|

|

City |

County |

State |

ZIP Code |

+4 |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone number |

|

|

Fax number |

|

|

|

|

|

Email address |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Mailing Address (PO Box acceptable) |

|

|

|

|

|

|

City |

|

|

State |

|

ZIP Code |

+4 |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Reason for applying (Check all that apply.): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

New business |

|

|

Additional location(s) |

|

|

|

Merger |

|

Purchased going business |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

Change of entity |

|

|

Remit use tax on purchases |

|

Reorganization |

|

Other (describe) ________________ |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Previous owner’s name: First Name or Corporation Name |

Last Name |

|

|

|

|

|

Title |

|

|

|

Telephone number |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Street Address (PO Box acceptable) |

|

|

|

|

|

|

City |

|

|

State |

ZIP Code |

+4 |

|

|||||||||||

8. Type of registration |

Maryland Number if registered: |

|||

a. |

|

Sales and use tax |

|

|

b. |

|

Transportation Network Company |

|

|

c. |

|

Tire recycling fee |

|

|

d. |

|

Admissions and amusement tax |

|

|

e. |

|

Employer withholding tax |

|

|

f. |

|

Unemployment insurance |

|

|

g. |

|

Alcohol tax |

|

|

h. |

|

Tobacco tax |

|

|

i. |

|

Motor fuel tax |

|

|

j. |

|

Transient vendor license |

|

|

9. |

Type of ownership: (Check one box) |

|

|

|

||

a. |

|

|

Sole proprietorship |

f. |

|

|

b. |

|

|

Partnership |

g. |

|

Governmental |

c. |

|

|

Nonprofit organization |

h. |

|

Fiduciary |

d. |

|

|

Maryland corporation |

i. |

|

Business trust |

e.

Limited liability company

Limited liability company

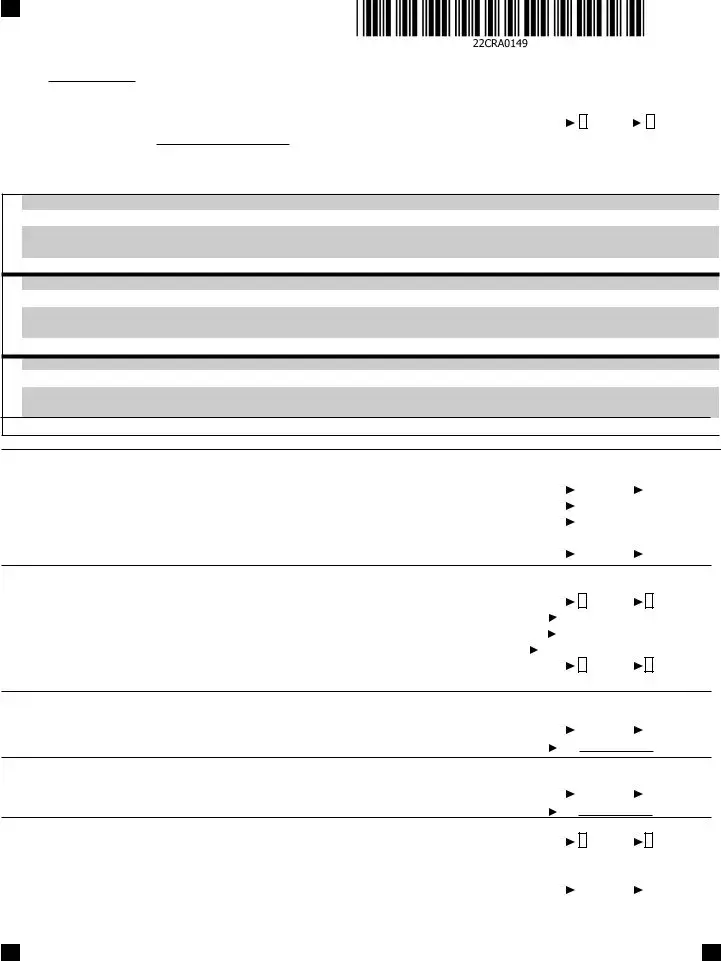

10. Date first sales made in Maryland: (MMDDYYYY)

11. Date first wages paid in Maryland subject to withholding : (MMDDYYYY)

12. If you currently file a consolidated sales and use tax return, enter the

13. If you have employees, enter the number of your worker’s compensation insurance policy or binder:

14.(a) Have you paid or do you anticipate paying wages to individuals, including corporate officers,

|

for services performed in Maryland? |

Yes |

|

No |

|

|

|

|

|||

|

(b) If yes, enter date wages first paid (MMDDYYYY) |

|

|

|

|

|

|

|

|

|

|

15. |

Number of employees: |

|

|

|

|

|

|

|

|

|

|

16. |

Estimated gross wages paid in first quarter of operation: |

|

|

|

|

|

|

|

|

|

|

17.Select the option that best describes your situation (Check ONLY ONE box):

Applicant has a physical sales location within Maryland and will not make online sales to customers in Maryland.

Applicant will make online sales to Maryland customers and does not have a physical sales location in Maryland.

Applicant has a physical sales location in Maryland and will make online sales to customers in Maryland.

Applicant does not make sales. The sales and use tax account is requested for reporting use tax only.

18.Describe for profit or nonprofit business activity that generates revenue. Specify the product manufactured and/or sold, or the type of service performed.

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

19.Are you a nonprofit organization exempt under Section 501(c)(3) of the Internal Revenue Code?

If no, Section (c) ( |

) or Other: Section |

. |

||

|

|

|

|

|

Yes

No

MARYLAND |

COMBINED |

2022 |

|

FORM |

|||

REGISTRATION |

page 2 |

||

CRA |

|||

APPLICATION |

|||

|

FEIN/SSN

20.Does the business have only one physical location in Maryland?

(Do not count client sites or off site projects that will last less than one year.) If no, specify how many:

Yes

No

21.Identify owners, partners, corporate officers, trustees, or members: (List person whose Social Security Number is listed in Section A.1b, first.) * Partnerships and nonprofit organizations must identify at least two owners, partners, corporate officers, trustees or members. If more space is required, attach a separate statement including the information as shown here.

1

2

3

Last Name |

First Name |

|

Social Security Number |

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address |

|

|

|

|

|

|

|

|

|

Street address |

City |

|

State |

ZIP |

Telephone |

|

|

|

|

|

|

Last Name |

First Name |

|

Social Security Number |

|

Title |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address |

|

|

|

|

|

|

|

|

|

Street address |

City |

|

State |

ZIP |

Telephone |

|

|

|

|

|

|

Last Name |

First Name |

|

Social Security Number |

|

Title |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address |

|

|

|

|

|

|

|

|

|

Street address |

City |

|

State |

ZIP |

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B: Complete this section to register for an unemployment insurance account.

PART 1.

1. |

Will corporate officers receive compensation, salary or distribution of profits? |

|

Yes |

|

No |

|

|

If yes, enter date (MMDDYYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Department of Assessments and Taxation Entity Identification Number. |

|

|

|

|

|

|

|

|

|

|

|

|

3.Did you acquire by sale or otherwise, all or part of the assets, business, organization,

or workforce of another employer? |

|

Yes |

|

No |

4.If your answer to question 3 is “No,” proceed to item 5 of this section. If your answer to question 3 is “Yes,” provide the information below. a. Is there any common ownership, management or control between the

|

current business and the former business? |

|

|

Yes |

No |

b. |

Percentage of assets or workforce acquired from former business: |

|

|

|

|

c. |

Date former business was acquired by current business (MMDDYYYY): |

|

|

|

|

d. |

Unemployment insurance number of former business, if known: |

00 |

|

|

|

e. |

Did the previous owner operate more than one location in Maryland? |

|

|

Yes |

No |

|

|

How many? |

|

|

|

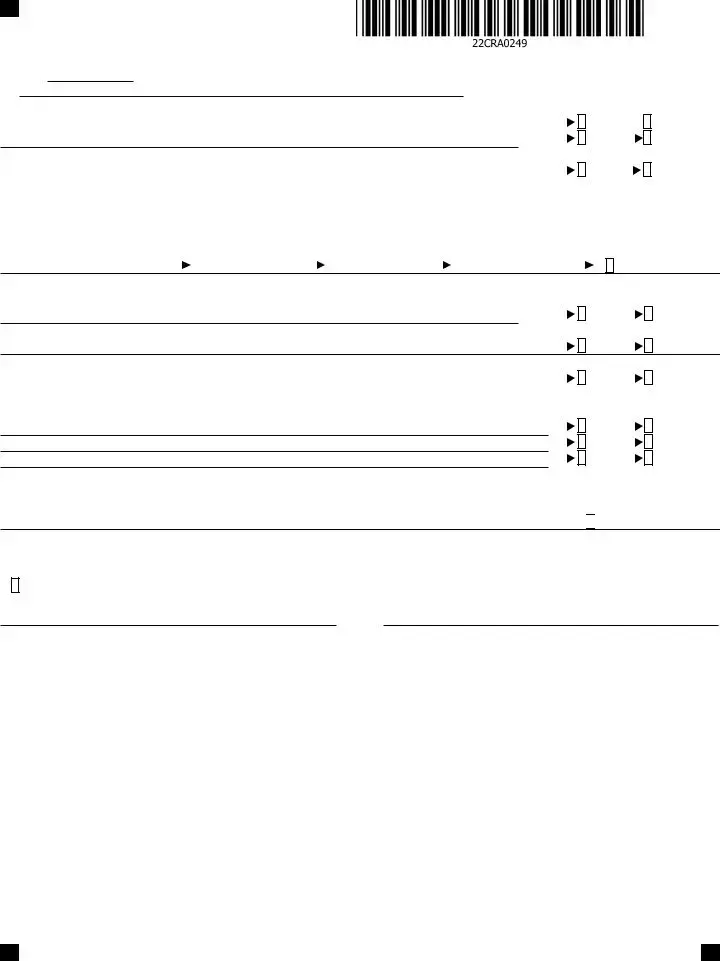

5.For employers of domestic help only:

a. Have you or will you have as an individual or local college club, college fraternity or

sorority a total payroll of $1,000 or more in the State of Maryland during any calendar quarter? |

|

Yes |

|

No |

b. If yes, indicate the earliest quarter and calendar year (MMDDYYYY):

6.For agricultural operating only:

a. Have you had or will you have 10 or more workers for 20 weeks or more in any calendar year

or have you paid or will you pay $20,000 or more in wages during any calendar quarter? |

|

Yes |

|

No |

b. If yes, indicate the earliest quarter and calendar year (MMDDYYYY)

7.For Limited Liability Companies only:

a. As a Limited Liability Company, do you employ anyone other than a member? |

Yes |

No |

b.Has the Limited Liability Company filed IRS form 8832 whereby it elected to be classified as a corporation or is the Limited Liability Company automatically classified as a

corporation for federal tax purposes? |

|

Yes |

|

No |

MARYLAND |

COMBINED |

2022 |

|

FORM |

|||

REGISTRATION |

page 3 |

||

CRA |

|||

APPLICATION |

|||

|

FEIN/SSN

PART 2. COMPLETE THIS PART IF YOU ARE A NONPROFIT ORGANIZATION

1.Are you subject to tax under the Federal Unemployment Tax Act?

If not, are you exempt under Section 3306(c)(8) of the Federal Unemployment Tax Act?

2.Are you a nonprofit organization as described in Section 501(c)(3) of the United States Internal Revenue Code which is exempt from Income Tax under Section 501(a) of such code?

If YES, attach a copy of your exemption from Internal Revenue Service.

3. |

Elect option to finance unemployment insurance coverage. See instructions. |

|

|

a. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. |

|

|

If b. is checked, indicate the total taxable payroll ($8,500 maximum per individual |

|

|

|

|

||||||||

|

per calendar year) $ |

|

for calendar year 20 |

|

. |

|

|

|

|

|

|

||

|

Type of collateral (check one): |

|

|

Letter of credit |

|

|

Surety bond |

|

Security deposit |

||||

|

|

|

|

|

|

||||||||

Yes  No

No

Yes No

Yes |

No |

Contributions Reimbursement of trust fund

Cash in escrow

SECTION C: Complete this section if you are applying for an alcohol or tobacco tax license.

1.Will you engage in any business activity pertaining to the manufacture, sale, distribution, or storage of alcoholic beverages (excludes retail)?

2.Will you engage in any wholesale activity regarding the sale and/or distribution

of tobacco in Maryland (excludes retail)?

Yes

Yes

No

No

SECTION D: Complete this section if you plan to sell, use or transport any fuels in Maryland.

1.Do you plan to import or purchase in Maryland, any of the following fuels for resale, distribution, or for your use? If yes, check type(s) below:

|

|

Gasoline (including av/gas) |

|

Turbine/jet fuel |

|

Special fuel (any fuel other than gasoline) |

|

|

|

|

|

|

|

|

|

2.Do you transport petroleum in any device having a carrying capacity exceeding 1,749 gallons?

3.Do you store any motor fuel in Maryland?

4.Do you have a commercial vehicle that will travel interstate?

Yes

Yes

Yes

Yes

No

No

No

No

If you have answered “Yes” to any question in Section C or D, call the

SECTION E: Complete this section to request paper coupons.

We provide a free and secure electronic method to file sales and use tax and withholding returns, using bFile on the Comptroller’s Web site www.marylandtaxes.gov. If you prefer instead to receive your future tax filing coupons by mail, check here

SECTION F: All applicants must complete this section.

Under penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief it is true, correct and complete.

Check here if a power of attorney form is attached.

Print Name |

Title |

Signature* (Required by Law) |

Date |

|

|

|

|

|

|

Name of Preparer other than applicant |

|

|

Telephone number |

Email address |

*If the business is a corporation, an officer of the corporation authorized to sign on behalf of the corporation must sign; if a partnership, one partner must sign; if an unincorporated association, one member must sign; if a sole proprietorship, the proprietor must sign. (The signature of any other person will not be accepted unless a power of attorney is attached.)

MARYLAND |

COMBINED REGISTRATION |

2022 |

|

FORM |

|||

APPLICATION INSTRUCTIONS |

|

||

|

|

CRA

Use this application to register for:

•Admissions and amusement tax account

•Alcohol tax license*

•Income tax withholding account

•Motor fuel tax account*

•Sales and use tax license

•Use tax account

•Transient vendor license

•Transportation Network Company account

•Tire recycling fee account

•Tobacco tax license*

•Unemployment insurance account

*Further registration is required for motor fuel, alcohol or tobacco taxes before engaging in business. The appropriate division of the Comptroller’s Office will contact you and provide the necessary forms.

Other requirements

Depending on the nature of your business, you may be required to contact or register with other agencies. The following list may help you determine which agencies to contact.

•Local Licenses may be required for corporations or individu- als doing business in Maryland. Local licenses may be obtained from the Clerk of the Circuit Court for the jurisdiction in which the business is to be located.

•Domestic and foreign corporations and limited liability companies must register with the State Department of Assess- ments and Taxation, Charter Division, 301 West Preston Street, Baltimore, Maryland

•Individuals, sole proprietorships and partnerships which possess personal property (furniture, fixtures, tools, machinery, equipment, etc.) or need a business license must register and file an annual personal property return with the State Depart- ment of Assessments and Taxation, Unincorporated Personal Property Unit, 301 West Preston Street, Room 806, Baltimore, Maryland

•Every corporation and association (domestic or foreign) having income allocable to Maryland must file a state income tax return.

•All corporations whose total Maryland income tax for the cur- rent tax year can reasonably be expected to exceed $1,000 must file a declaration of estimated tax. For more information, call

•To form a corporation, contact the State Department of As- sessments and Taxation, 301 West Preston Street, Baltimore, Maryland

•Worker’s compensation insurance coverage for employees is required of every employer of Maryland. This coverage may be obtained from a private carrier, the Injured Worker’s Insur- ance Fund or by becoming

•Unclaimed property. The Maryland abandoned property law requires businesses to review their records each year to deter- mine whether they are in possession of any unclaimed funds and securities due and owing Maryland residents that have re- mained unclaimed for more than three years, and to file an annual report. Contact the Comptroller of Maryland, Unclaimed Property Section, 301 W. Preston Street, Baltimore, Maryland

•Charitable organizations may be required to register with the Secretary of State if contributions from the public are solicited. Contact the Secretary of State’s Office, 16 Francis St. #1, An- napolis, Maryland 21401 or call

•Weights and measures. If you buy or sell commodities on the basis of weight or measure, or use a weighing or measuring de- vice commercially, your firm is subject to the Maryland Weights and Measures Law. To obtain information, call the Department of Agriculture, Weights and Measures Section at

•Food businesses are required to be licensed with

Maryland |

Department |

of |

Health |

(MDH). |

Contact |

your local |

county health |

|

department |

or call |

MDH at |

|

|

|

|

||

Apply for licenses and open accounts

at www.marylandtaxes.gov

•Admissions and amusement tax account

•Income tax withholding account

•Sales and use tax license

•Tire recycling fee account

•Transient vendor license

•Unemployment insurance account

•Use tax account

Register online at www.marylandtaxes.gov

MARYLAND |

COMBINED REGISTRATION |

2022 |

|

FORM |

|||

APPLICATION INSTRUCTIONS |

Page 2 |

||

CRA |

|||

|

|

SECTION A

Incomplete applications cannot be processed and will be returned. To ensure your application is processed without delay, be sure to provide all requested information. Type or print clearly using blue or black ink. Before mailing this application, be sure to:

1.Complete all of Section A.

2.Answer all questions in all the other sections that pertain to your business.

3.Sign the application in Section F.

4.Detach this instruction sheet from the application.

5.Mail the application to:

Central Registration

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, MD

•Enter the Federal Employer Identification Number (FEIN) of the applicant. A FEIN is required by: all corporations, LLCs, partnerships, nonprofit organizations, and sole proprietorships who pay wages to one or more employees. A sole proprietorship with no employees, other than self, is not required to have a FEIN. If you do not have a FEIN, one can be obtained by visiting the IRS at www.irs.gov.

•Enter the Social Security Number (SSN) of the individual owner of the company, officer, agent of the corporation, or other person responsible for remitting the taxes. Also enter the name of the individual owner, officer or agent re sponsible for the taxes on the first line of Item 21.

•Enter the legal name of the business, organization, corporation (e.g., John Smith, Inc.), partnership (e.g., Smith & Jones), individual proprietor or professional (e.g., Smith, John T.), or governmental agency.

•Enter the registered trade name by which your business is known to the public (e.g., Smith’s Ceramics).

•Indicate the type of registration you are seeking. If you are already registered for any of the taxes listed, enter your registration number.

You will need a sales and use tax license if you are required to collect sales and use tax on your sales of tangible personal property and taxable services. Certain

NOTE: If you are not a nonprofit organization but purchase items for resale, you need a resale certificate and not a Sales and Use Tax Exemption Certificate. Check box 8.a. to open a valid Maryland sales and use tax account, from which you may issue resale certificates. Unless you are a nonprofit organization, you DO NOT qualify for a Sales and Use Tax Exemption Certificate. The Sales and Use Tax Exemption Certificate application (SUTEC Application) must be completed separately to receive a Sales and Use Tax Exemption Certificate. Exemption certificates are issued to nonprofit charitable, educational or religious organizations, volunteer fire or ambulance companies, volunteer rescue squads, nonprofit cemeteries, federal credit unions and certain veterans organizations, their auxiliaries or their units located in this State. Possession of an effective determination letter from the Internal Revenue Service stating that the organization qualifies under Sections 501(c)(3), 501(c)(4) or 501(c)(19) of the Internal

Revenue Code may be treated as evidence that an organization qualifies for this exemption. See the Maryland Sales and Use Tax Exemption Certificate Application for additional information.

You must register for a tire fee account if you will make any sales of tires to a retailer or you are a retailer who purchases tires from an

Typical activities subject to the admissions and amusement tax include:

Admissions to any place, including motion pictures, athletic events, races, shows and exhibits. Also subject to tax are receipts from athletic equipment rentals, bingo,

You must register for an account if you will make any payment that may be subject to income tax withholding, including withholding on the following: eligible rollover distributions, sick pay, annuity, or pension payments; designated distributions; and certain winnings from Maryland wagering. Both employers and payors of Maryland income tax withholding are required to check Box 8.e.

If you make sales of property subject to the sales and use tax from either motor vehicles or from roadside or temporary locations, you must, in addition to any other license required by law, obtain and display a transient vendor license. Transient vendor licenses will be issued and reissued only to persons who have sales and use tax and trader’s licenses and who are not delinquent in the payment of any Maryland taxes.

Exhibitors at fairs, trade shows, flea markets and individuals who sell by catalogs, samples or brochures for future delivery do not need transient vendor licenses.

SECTION B

Complete this section if you are an employer registering for unemployment insurance.

PART 1

All industrial and commercial employers and many nonprofit charitable, educational and religious institutions in Maryland are covered by the state unemployment insurance law. There is no employee contribution.

An employer must register upon establishing a new business in the State. If an employer is found liable to provide unemployment coverage, an account number and tax rate will be assigned. The employer must report and pay contributions on a report mailed to the employer each quarter by the Office of Unemployment Insurance.

Your Entity Identification Number is assigned by the Maryland State Department of Assessments and Taxation. It is an alpha- numeric identifier that appears on the acknowledgement received from that Department. The identifier also can be found on that Department’s website at www.dat.state.md.us. (Domestic and foreign corporations and limited liability companies are assigned a number when registering with that Department. Individuals, sole proprietors and partnerships who possess personal

Register online at www.marylandtaxes.gov

MARYLAND |

COMBINED REGISTRATION |

2022 |

|

FORM |

|||

APPLICATION INSTRUCTIONS |

Page 3 |

||

CRA |

|||

|

|

property or need a business license also obtain a number when completing the required registration with the State Department of Assessments and Taxation.)

PART 2

Complete this part if you are a nonprofit organization.

Item 1. Your exemption from the IRS should state if you are exempt from federal unemployment taxes.

Item 2. Check the appropriate box and include a copy of the IRS exemption, if applicable.

Item 3. Indicate your option to finance unemployment insurance coverage:

Option a. - Contributions.

The employer has the option to pay contributions. A rate assigned by the administration is applied to the first $8,500 of wages paid to each employee during a calendar year. Contributions are paid on a calendar quarter basis.

An employer who has not been subject to the Maryland unemployment insurance law for a sufficient period of time to have its rates computed is required to pay at the new account rate, which is approximately 2.3%. Thereafter, the employer will be assigned a rate reflecting its own experience with layoffs. If the employer’s former employees receive benefits regularly that result in benefit charges, the employer will have a higher tax rate. Employers that incur little or no benefit charges will have a lower tax rate.

Option b. - Reimbursement of Trust Fund.

The employer may elect to reimburse the trust fund. At the end of each calendar quarter, the employer is billed for unemployment benefits paid to its former employees during the quarter. A nonprofit organization that elects to reimburse must also provide collateral to protect the administration from default in reimbursement.

If b. is checked, indicate which method of providing collateral you will use.

For more information on the financing options, visit www.dllr. state.md.us or call

Power of Attorney

A power of attorney is necessary if you wish us to disclose information to someone other than the owner or individual who signed. Complete Maryland Form 548 or 548P and attach to your application. The form must also include (1) type of tax (income, employment), (2) Maryland tax form number (CRA, 502, MW506, etc.) and (3) year(s) or period(s) covered.

Executive order on privacy and state data system security notice

The information on this application will be used to determine if you are liable for certain taxes, to register you, and, where appropriate, to issue a required license.

If you fail to provide required information, you will not be properly registered with state tax authorities, and necessary licenses may not be issued. If you operate a business without the appropriate registration and licenses, you may be subject to civil and criminal penalties, including confiscation in some instances.

If you are a sole proprietor, partner or officer in a corporation, you have the right to inspect any tax records for which you are

responsible, and you may ask the tax authorities to correct any inaccurate or incomplete information on those records.

This application and the information you provide on it are generally not available for public inspection. This information will be shared with the state tax authorities with whom you should be registered.

Other licenses you may need

In addition to a sales and use tax license, you also may need to obtain one or more of the licenses listed below from your local Clerk of the Court to operate your business in Maryland:

•Auctioneer

•Chain store

•Cigarette

•Commercial garage

•Console machine

•Construction firm

•Hawkers & peddlers

•Junk dealer

•Laundry

•Music box

•Pinball

•Plumber & gas fitter

•Restaurant

•Special cigarette

•Storage warehouse

•Traders

•Vending machine

•Wholesale dealer – farm machinery

These licenses are issued by the Clerk of the Circuit Court in the County (or Baltimore City) where the business is located. If your business falls into one or more of the above categories, contact the Clerk of the Circuit Court in your county courthouse.

Check government pages of your local telephone directory for the street address and phone number. The clerk also can advise you on any local licensing requirements.

Register online

You can file your Combined Registration Application online at www.marylandtaxes.gov 24 hours a day. You only view and complete the parts of the application that apply to your situation.

It is fast and easy. You will receive a confirmation number immediately and your account information will be in the mail quickly.

Further registration is required for motor fuel, alcohol or tobacco taxes before engaging in business. The appropriate division of the Comptroller’s Office will contact you and provide necessary forms.

Register online at www.marylandtaxes.gov

MARYLAND |

COMBINED REGISTRATION |

2022 |

|

FORM |

|||

APPLICATION INSTRUCTIONS |

Page 4 |

||

CRA |

|||

|

|

Registration by telephone / Authorized personnel

Central Registration accounts may be reopened and modified by telephone:

An account may be reopened if it has not been closed for more than three (3) years and if the owners, partners, corporate officers, trustees, or members have not changed.

Most tax types may be added to an existing Central Registration account by telephone:

•Admissions and amusement tax account

•Income tax withholding account

•Sales and use tax license

•Use tax account

•Tire recycling fee

•Transient vendor license

•Unemployment insurance account

Telephone registration eliminates the need for you to fill

out another Combined Registration Application. Call 410-

For any changes to the account, the taxpayer will need to submit the information either in writing, by fax, or email at TAXHELP@marylandtaxes.gov.

Register by fax

File your Maryland Combined Registration Application by fax 24 hours a day. When applying by fax, be sure to complete Sections A and E of the application and any other sections that apply to your business. You must provide your federal employer identification number, if available, and Social Security Number requested in Section A1 and describe your business in Section A18. Do not fax a cover sheet or our instructions. The Central Registration fax number is

In the event of a disaster or an emergency

If the Governor of Maryland declares a state of emergency, or, the President declares a federal major disaster or state of emergency, or, there is a widespread utility outage, any

These

•State and local licensing or registration requirements

•State or County income taxes

•Unemployment insurance contributions

•Personal property tax

•Sales and Use Tax requirements

•Employer withholding tax requirements

However, such businesses must provide a statement related to the disaster to the Comptroller of Maryland with the following information:

•Company name

•State of domicile

•Principal address

•Federal Tax Identification Number

•Date of entry into the state

•Contact information

For more information

Visit www.marylandtaxes.gov or email your question to TAXHELP@marylandtaxes.gov. You may also call

Central Registration

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, MD

Allow two weeks for processing the Combined Registration Application. You will receive your license and coupons (if requested) by U.S. mail.

Register online at www.marylandtaxes.gov

File Breakdown

| Fact Name | Fact Detail |

|---|---|

| Form Identification | The Maryland Combined Registration Application is officially designated as COM/RAD-093. |

| Purpose | This form is utilized for multiple registrations including but not limited to sales and use tax, employer withholding tax, and unemployment insurance accounts. |

| Sections Overview | The form comprises sections A through F, each designed to collect specific information critical for the registration process. |

| Governing Law | The application is governed by state laws regulating the specific types of accounts and activities it covers, such as sales and use tax (Title 11 of the Maryland Tax-General Article), employer withholding, and unemployment insurance (Title 8 of the Maryland Labor and Employment Article). |

| Registration Requirements | Applicants must provide detailed information including Federal Employer Identification Number (FEIN), legal business names, types of ownership, and the nature of the business activities. |

| Special Notes for Nonprofits | Nonprofit organizations must indicate their exemption status under Section 501(c)(3) or other applicable sections of the Internal Revenue Code. |

| Addendum for Specific Registrations | Sections beyond Section A are tailored for specific registrations like unemployment insurance, reflecting additional requirements such as compensation to corporate officers and details on previous business acquisitions. |

Steps to Filling Out Maryland Cra

Filling out the Maryland Combined Registration Application (CRA) form is a crucial step for businesses to ensure they are registered for the appropriate tax accounts and licenses in Maryland. This step-by-step guide simplifies the process, helping business owners through each part of the application accurately.

- Begin with Section A: This is mandatory for all applicants to complete.

- Provide your Federal Employer Identification Number (FEIN) or, if applicable, the Social Security Number (SSN) of the owner, officer, or agent responsible for taxes.

- Enter the legal name of the dealer, employer, corporation, or owner and the trade name if it differs.

- Fill in the street address of the physical business location. Note: PO Box addresses are not acceptable here.

- Supply a mailing address, which can be a PO Box if preferred.

- Check the appropriate box(es) in the "Reason for applying" section based on your business needs.

- If applicable, provide information about the previous owner.

- Select the type(s) of registration you are applying for from the list provided.

- Indicate the type of ownership of your business.

- Enter the dates when first sales and/or wages were paid in Maryland, as applicable.

- Answer additional questions regarding wages, number of employees, and your business's operational scope in Maryland.

- Describe your business activity, focusing on the products manufactured/sold or the type of service performed.

- If your organization is a nonprofit, indicate whether it is exempt under Section 501(c)(3) of the Internal Revenue Code.

- For businesses with multiple physical locations in Maryland, specify the number.

- List the owner(s), partners, corporate officers, trustees, or members, starting with the person whose SSN is provided in step 1b.

- Move to Section B if you need to register for an unemployment insurance account and complete as directed.

- If applicable, complete Section C for alcohol or tobacco tax licenses, and Section D for fuel-related licenses.

- Section E is optional for those preferring to receive future tax filing coupons by mail.

- In Section F, certify the application by printing your name, title, and signing the form. The date and contact information of the preparer (if not the applicant) should also be included.

After completing the form, detach the instruction sheet, and mail the application to the address provided in the instructions, ensuring you've answered all relevant questions and sections based on your business activities. Remember, accurate and complete applications help speed up the registration process, allowing you to focus on running your business.

More About Maryland Cra

What is the Maryland Combined Registration Application (CRA) Form?

The Maryland Combined Registration Application (CRA) Form is a comprehensive document used by businesses, non-profits, and other organizations to register for various taxes and licenses in the state of Maryland. This includes registrations for sales and use tax, admissions and amusement tax, alcohol and tobacco tax licenses, and unemployment insurance, among others.

Who needs to complete the Maryland CRA Form?

Any new business or organization operating in Maryland, existing businesses that are re-organizing, changing entity types, or adding new locations, and those purchasing an existing business should complete the CRA Form. Non-profit organizations, government entities, and businesses hoping to obtain specific tax licenses or accounts must also register through this form.

What types of registrations can be applied for with the CRA Form?

The CRA Form allows applicants to register for a variety of accounts and licenses, including, but not limited to:

- Sales and use tax license

- Admissions and amusement tax account

- Alcohol tax license

- Tobacco tax license

- Unemployment insurance account

- Transient vendor license

- Tire recycling fee account

What information is needed to fill out the CRA Form?

To complete the CRA Form, you will need to provide the following:

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN) for owner/officer/agent responsible for taxes

- Legal name and trade name of the organization

- Physical and mailing addresses of the business

- Type and nature of the business activity

- Types of registration needed

- Details about employees, if applicable

Can a business without a physical location in Maryland apply for a sales and use tax account?

Yes, businesses without a physical location in Maryland but making online sales to Maryland customers can apply for a sales and use tax account using the CRA Form. It's important for these businesses to comply with Maryland's tax laws regarding online sales.

How does a non-profit organization apply for tax-exempt status in Maryland?

Non-profit organizations seeking tax-exempt status in Maryland should indicate their non-profit status on the CRA Form and provide a copy of their exemption from Income Tax under Section 501(c)(3) of the Internal Revenue Code, if applicable. Additionally, they must apply separately for a Sales and Use Tax Exemption Certificate if they qualify.

What happens after submitting the CRA Form?

After submitting the CRA Form, the Maryland Comptroller's Office will process the application. If approved, the business will receive account numbers and further instructions for each type of registration or license applied for. It is essential for businesses to keep these documents for their records and comply with all filing and payment requirements.

Where can I find more information or assistance with the CRA Form?

Additional information and assistance with the CRA Form are available on the Maryland Comptroller's website at www.marylandtaxes.gov. Businesses can also contact the Maryland Comptroller's Office directly for help with the application process or any questions regarding state taxes and registrations.

Is online registration available for the Maryland CRA Form?

Yes, Maryland offers online registration through the Comptroller’s website, providing a convenient option for businesses to submit their CRA Form electronically. Online registration can speed up the process and help ensure accuracy.

Can changes or updates to business information be made after submitting the CRA Form?

Yes, if there are changes to the business information or if additional licenses or accounts are needed after the initial registration, businesses should update their information with the Comptroller’s Office. This may include changes in address, business activity, ownership, or other relevant details.

Common mistakes

Failing to provide a Federal Employer Identification Number (FEIN) or Social Security Number (SSN) for the owner, officer, or agent responsible for taxes. This oversight can result in an incomplete application, causing delays.

Not using the legal name of the business or organization can lead to confusion and potential legal issues, especially if there are name discrepancies with other registrations or legal documents.

Entering a PO Box instead of the physical street address of the business location. A physical address is required for verification and correspondence purposes.

Using a trade name without registering it or ensuring it matches records. Consistency with public-facing and legal documents is crucial for identification and branding.

Omitting an email address, which can hinder timely communication regarding the application status, necessary follow-ups, or updates from the Maryland Department of Taxation.

Not clearly stating the reason for applying, such as a new business or a change in entity. This information helps tailor the processing and evaluation of the application.

Skipping the previous owner's details can lead to incomplete background information, essential for businesses that are being purchased or have changed ownership.

Not selecting the appropriate type of registration needed. Each tax or license requires specific information and documentation, affecting processing times and compliance.

Incorrectly indicating the type of ownership, which could affect tax obligations and legal responsibilities. This should match the structure under which the business legally operates.

Leaving the dates of first sales or wages paid in Maryland blank. These dates are critical for tax reporting requirements and establish operational timelines.

When filing out the Maryland Combined Registration Application, attention to detail and completeness are vital. Ensuring accurate and full responses not only facilitates smoother processing but also supports compliant business operations.

Documents used along the form

When applying for or updating business details using the Maryland Combined Registration Application (CRA) Form, several additional documents often accompany or follow this primary form to complete the process efficiently. Entities may need to interact with various regulatory and taxation frameworks within the state, requiring specific forms for compliance and operational purposes. Understanding these documents can streamline the registration process and ensure a business meets all legal requirements in Maryland.

- Articles of Incorporation: This document is essential for newly established corporations. It officially forms the corporation and includes details such as the corporation's name, purpose, stock information, and incorporator details.

- Articles of Organization: Required for Limited Liability Companies (LLCs), this document establishes the LLC with the state and includes information on the LLC's name, purpose, duration, and management structure.

- Business License Application: Essential for businesses that operate in certain trades or professions, this state or local government-issued document authorizes the business to conduct its activities in Maryland.

- Employer Identification Number (EIN) Confirmation Letter (IRS Form SS-4 Confirmation): This document from the Internal Revenue Service confirms a business's EIN, a necessity for tax filing and reporting purposes.

- Trade Name Application: If a business operates under a name different from its legal name, this document registers the trade name with the state.

- Workers' Compensation Insurance Compliance Certificate: This certificate proves a business's compliance with Maryland's requirement to provide workers' compensation insurance.

- Unemployment Insurance Account Number Notification: Issued by the Maryland Department of Labor, this notifies a business of its unemployment insurance account number, enabling it to comply with unemployment insurance tax requirements.

- Local County/City Business License: Depending on the business location, a local license may be required in addition to the state business license for operational legality within certain jurisdictions.

- Power of Attorney (POA): If a business owner or representative wishes to authorize another individual to handle tax or legal matters in Maryland, a POA form is used to grant this authority officially.

Together, these documents complement the Maryland CRA Form, covering a broad range of legal, operational, and taxation aspects of a business's setup and ongoing compliance. Proper documentation ensures smooth interactions with state departments, legal compliance, and a solid foundation for business operations in Maryland. Understanding each document's purpose and requirements can help businesses navigate the complexities of state registration and compliance processes efficiently.

Similar forms

The Maryland Combined Registration Application (CRA) form is similar to several other forms utilized by businesses and organizations for registration and tax purposes. This comparison aims to clarify the similarities between the Maryland CRA form and other documents such as the IRS Form SS-4 and state-specific business registration forms. By understanding these parallels, applicants can better navigate the complexities of regulatory compliance.

Firstly, the Maryland CRA form shares similarities with the Internal Revenue Service (IRS) Form SS-4, which is used to apply for an Employer Identification Number (EIN). Both forms require detailed information about the business, including the legal name, trade name, and address. They also request data about the ownership type (e.g., sole proprietor, partnership, corporation) and the principal activity of the business. However, the IRS Form SS-4 is focused on federal tax identification, while the Maryland CRA encompasses a broader scope of state-specific registrations, such as sales and use tax, unemployment insurance, and worker's compensation insurance.

Secondly, the form is comparable to state-specific business registration forms, such as the California Secretary of State's Business Entity Registration form. Both forms serve the purpose of officially recognizing a business within their respective states and require information on the business's nature, ownership, and operational details. The major distinction lies in the Maryland CRA's comprehensive approach, integrating multiple tax registrations and business credentials in one application, streamlining the process for new or expanding businesses in Maryland. This contrasts with California's approach, where separate forms might be needed for different types of tax and business registrations.

In summary, while the Maryland CRA form parallels the IRS Form SS-4 and other state-specific business registration documents in collecting essential business information and facilitating regulatory compliance, its comprehensive nature and specific requirements reflect Maryland's unique regulatory environment. Understanding these similarities and differences assists businesses in navigating the registration process more effectively.

Dos and Don'ts

When completing the Maryland Combined Registration Application (CRA) form, there are several critical steps to remember, as well as common mistakes to avoid. Here is a guide to help ensure the process is completed accurately and efficiently.

- Do ensure that all required sections of the form are completed. This includes providing accurate information for the Federal Employer Identification Number (FEIN) or Social Security Number (SSN), business name, ownership type, and registration for specific taxes or licenses.

- Do not leave any sections incomplete. Incomplete applications cannot be processed and will be returned, causing unnecessary delays in obtaining the necessary registrations.

- Do verify the accuracy of all provided information, including checking the spelling of names, accuracy of addresses, and the correct identification numbers. Mistakes in these areas can lead to significant problems later on.

- Do not use a P.O. Box as the physical location address. The form specifically requires the street address of your physical business location for Section A, Item 4.

- Do ensure that the person responsible for taxes enters their SSN in Section A, item 1b, as required by law. This establishes accountability and ensures compliance with tax obligations.

- Do not guess on dates or other information. If you're unsure about details like the date first sales were made in Maryland or the date first wages were paid, take the time to verify them before submission.

- Do indicate the type of ownership and the specific taxes or licenses you are applying for by checking the appropriate boxes in Section A, Items 8 and 9. This helps in accurately categorizing your business for state records.

- Do not forget to sign and date the application in Section F. An unsigned application is considered incomplete and cannot be processed.

Following these guidelines will help streamline the application process, reducing errors and the likelihood of delays. Completing the form carefully and accurately is crucial for ensuring compliance with Maryland's business registration requirements.

Misconceptions

When it comes to the Maryland Combined Registration Application (CRA) form, there are several misconceptions that can cause confusion for applicants. Understanding these misconceptions is crucial for completing the form accurately and efficiently. Below are seven common misunderstandings about the CRA form:

- Any physical address will suffice for the business location. Contrary to this belief, a P.O. Box is not acceptable as the street address of the physical business location. The form requires the actual physical address to ensure legitimacy and for potential on-site verification.

- The Social Security Number (SSN) of the owner is optional. In fact, providing the SSN of the owner, officer, or agent responsible for taxes is required by law. This is crucial for tax purposes and identity verification within the state's tax system.

- Trade name and legal name can be used interchangeably. This is incorrect. The legal name refers to the registered name of the business while the trade name is the name under which the business operates publicly. Both must be specified if they differ.

- It’s optional to identify the type of registration being applied for. Applicants must check all that apply for their business situation, including new business, additional location(s), change of entity, and others. This information helps determine the specific taxes and licenses the business must register for.

- Nonprofit organizations don't need to submit additional documentation. If claiming exemption under Section 501(c)(3) or other applicable sections of the Internal Revenue Code, nonprofit organizations must attach proof of their status. This is crucial for receiving tax exemptions.

- Sales and use tax licenses are automatically applicable for exemption certificates. This is a common misconception. Businesses needing a Sales and Use Tax Exemption Certificate must apply separately. Not all entities with a sales and use tax license qualify for tax-exempt status.

- Completing only Section A is sufficient for submission. While Section A is mandatory for all applicants, completing other parts of the form is essential based on the business’s specific needs. Sections B through F may also require completion for registration of unemployment insurance, sales and use tax, alcoholic beverages licenses, and more.

Understanding these misconceptions and accurately completing the Maryland CRA form is vital for businesses to comply with state regulations, avoid potential fines, and ensure proper registration for taxes and licenses.

Key takeaways

When filling out the Maryland Combined Registration Application (CRA) form, it is crucial for all applicants to meticulously complete Section A. This section requests basic but vital information, including the Federal Employer Identification Number (FEIN) or Social Security Number (SSN) of the individual responsible for tax duties, the legal business name, trade name if applicable, physical business address, and mailing address. Not providing complete and accurate information in this section may result in the application being delayed or not processed.

The CRA form serves multiple purposes and allows businesses to register for a wide array of taxes and accounts in Maryland. This includes, but is not limited to, sales and use tax, employer withholding tax, unemployment insurance, alcohol tax, and tobacco tax licenses. Applicants must identify the specific tax accounts or licenses for which they are applying by checking the appropriate boxes in Section A, and providing additional required information in the subsequent sections depending on the accounts or licenses needed.

Special consideration is given to nonprofit organizations. Nonprofits seeking exemption from sales and use tax must check their status and are required to attach a copy of their exemption from the Internal Revenue Service to the application. The CRA form specifically queries applicants about their 501(c)(3) status and other pertinent nonprofit classification sections from the Internal Revenue Code.

Businesses with physical locations in Maryland or engaging in certain activities may need further registration beyond the CRA application. This includes entities planning to engage in the manufacture, sale, distribution, or storage of alcoholic beverages or tobacco products, or those intending to import, sell, use, or transport motor fuels. Section C and D of the CRA form indicate that contact with specific Comptroller’s Office divisions will be necessary for further instructions and forms.

The option to receive tax filing coupons by mail is provided in Section E, despite the state's preference for electronic filing through the bFile system. This highlights Maryland's flexibility in accommodating businesses' preferences for tax reporting and payments, although applicants are encouraged to utilize the electronic options available for efficiency and security.

Finally, the accuracy and truthfulness of the information provided in the CRA form are legally binding. The requirement for a signature under penalties of perjury in Section F emphasizes the seriousness of the application process. Applicants are responsible for ensuring that all provided data is correct to the best of their knowledge and belief, which underscores the need for careful review before submission.

Common PDF Templates

Maryland Wage Claim - Aimed at promoting fairness in the workplace by ensuring all employees receive due compensation.

Maryland State Sales Tax - A necessary document for businesses in Maryland seeking tax exemption on purchases intended for resale or production purposes.

Maryland State Compliance Application - The application details both general permit and excepted tests registration.