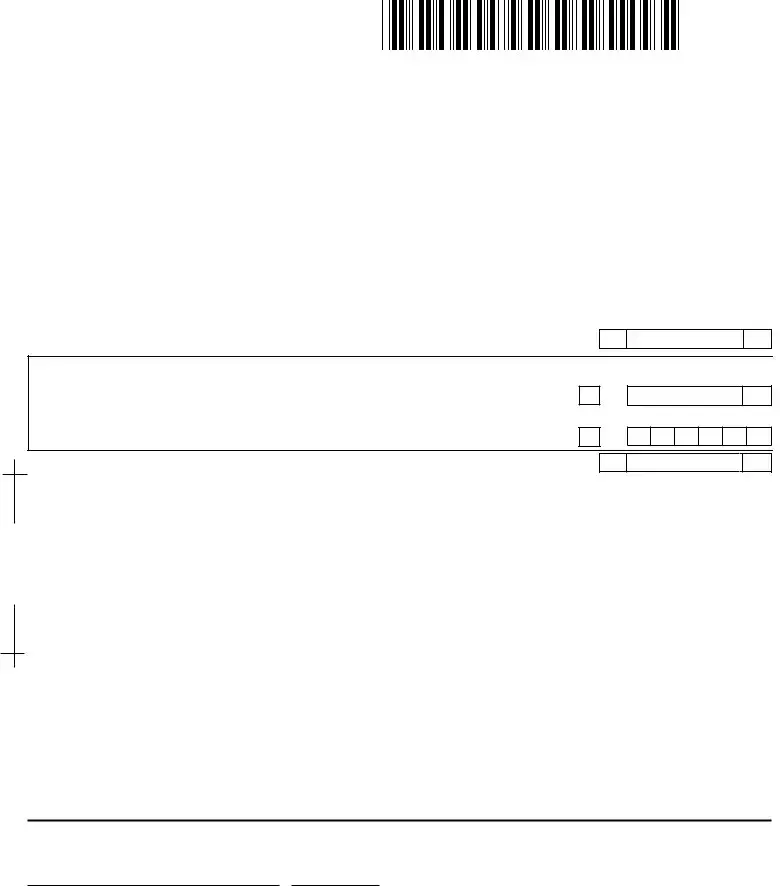

Maryland Frorm 510 PDF Template

The Maryland Form 510 is a crucial document for pass-through entities operating within the state, encompassing S Corporations, Partnerships, Limited Liability Companies, and Business Trusts. This income tax return form for the year 2002, or the applicable fiscal year, requires detailed information starting from the entity's name, Federal Employer Identification Number, and the date of organization or incorporation. It demands a meticulous report on the number of partners, shareholders, or members, categorizing them as individual residents, nonresidents, and others, while also spotlighting the entity’s business activity code. Vital aspects of the form include the total distributable or pro-rata income as per the federal return, with special instructions for multistate pass-through entities. Furthermore, it delves into the allocation of income, specifying separate accounting for non-Maryland income and an apportionment method for allocating Maryland income. The form guides on calculating nonresident tax, introduces the concept of distributable cash flow limitation, and discusses payments including estimated and tentative pass-through entity nonresident tax. Key to its completion is ensuring accuracy and adherence to tax regulations to avoid penalties, summarizing the tax due or overpaid, and requiring a declaration of accuracy under penalty of perjury by an authorized partner, officer, or member. Thus, Maryland Form 510 serves as a comprehensive blueprint for pass-through entities to navigate their state income tax obligations effectively.

Maryland Frorm 510 Sample

MARYLAND

FORM

2002

$

|

(OR FISCAL YEAR BEGINNING |

, 2002, ENDING |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

▶ Federal Employer Identification No. (9 digits) |

|

Do not write in this space |

|

|

|

|

|

|

|

|

||

PrintPlease InkBlackorBlueOnly |

|

|

|

|

|

|

ME ▶ |

|

|

|

|

|

|

|

|

|

|

Number and street |

|

|

|

FEIN Applied for date |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

YE ▶ |

|

|

|

|

|

|

|

|

|

|

|

City or town |

|

State |

Zip code |

▶ Date of Organization or Incorporation (MMDDYY) |

▶ Business Activity Code No. (6 digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Staple check here

TYPE OF ENTITY: |

☐ S Corporation |

☐ Partnership |

☐ Limited Liability Company |

☐ Business Trust |

CHECK HERE IF: |

☐ Name or address has changed |

☐ Inactive entity |

☐ AMENDED RETURN |

|

|

☐ First filing of the entity |

☐ Final return |

☐ Manufacturing Entity |

|

|

|

|

|

|

1. Number of partners, shareholders or members: |

|

|

|

|

a) Individual residents (of Maryland) ___________ |

b) Individual nonresidents ___________ ◀ c) Others ___________ ◀ d) Total ________________◀ |

|||

2.Total distributive or pro rata income per federal return (Form 1065 or 1120S) Ñ Unistate entities or multistate entities with no

▶ 2 nonresident partners, shareholders or members also enter this amount on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ALLOCATION OF INCOME |

|

|

|

(To be completed by multistate |

|||

|

▶ |

3a |

|

3a. |

|

|

|

3b. Maryland apportionment factor from computation worksheet on Page 2 (for entities using the apportionment method.) |

|

|

|

|

▶ |

3b |

|

Multiply line 2 by this factor and enter the result on line 4 (If factor is zero, enter 000001) |

|

|

. |

|

|

|

4 |

4. Distributive or pro rata share allocable to Maryland |

. . . |

. . . . . |

. |

NOTE: Do not complete lines 5 through 9 if line 1b is equal to “0”; that is, if the

|

|

|

|

|

|

|

|

5 |

|

. |

|

|

|

|

5. |

Percentage of ownership by individual nonresidents shown on line 1b (or profit/loss percentage if applicable) |

▶ |

|

|

|

|

|

|

||||||

. . . |

|

|

|

|

|

|

|

|||||||

6. |

Distributive or pro rata share for nonresident partners, shareholders or members (Multiply line 4 by the percentage on line 5) . |

|

▶ |

6 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Nonresident tax (Multiply line 6 x 4.75%) |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

. . . |

. |

. . . . . |

. . . . . . . . . . . . |

. . . |

|

|

|

|

|

|

|

|

||

8. |

Distributable cash flow limitation from worksheet on page 3 of instructions. If worksheet used, check here ☐ ◀ |

|

|

▶ |

8 |

|

|

|

|

|

||||

. . . |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Nonresident tax due (Enter the lesser of line 7 or 8) |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

. . . |

|

. . . . . |

. . . . . . . . . . . . |

. . . |

|

|

|

|

|

|

|

|

||

PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10a. |

Estimated |

▶ |

|

10a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. |

Tentative |

▶ |

|

10b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Total payments (Add lines 10a and 10b) |

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

10c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Balance of tax due (If line 9 exceeds line 10c enter the difference) |

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

▶ |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Interest and/or penalty (See instructions) |

|

|

|

|

|

|

▶ |

12 |

|

|

|

|

|

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Total balance due (Add lines 11 and 12) Pay in full with this return |

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

13 |

|

|

|

|

|

|

NOTE: The total tax paid from line 10c must be reported either on the composite return or on the return of |

|

|

|

|

|

|

|

|

|

|||||

the nonresident partners or shareholders. (For additional information see the instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE AND VERIFICATION: Under penalties of perjury, I declare that I have examined this return (including attachments) and, to the best of my knowledge and belief, it is true, correct and complete. (Declaration of preparer other than the taxpayer is based on all information of which preparer has any knowledge.)

Check here ☐ if you authorize your preparer to discuss this return with us.

|

PartnerÕs, officerÕs or memberÕs signature |

Date |

|||

|

|

|

|

|

|

|

Title |

|

|

▶ ☐ Check here if you |

|

|

Make checks payable to: COMPTROLLER OF MARYLAND. |

|

|||

|

Write federal employer identification no. on check using blue or black ink. |

use a paid preparer and do |

|||

|

Mail to: Comptroller of Maryland, Revenue Administration Division, |

|

not want Maryland forms |

||

|

|

Annapolis, Maryland |

|

mailed to you next year. |

|

COM/RAD 069 |

|

|

|

||

|

|

|

|

◀ |

|

|

|

|

|

|

|

|

|

|

|

|

|

PreparerÕs signature |

|

PreparerÕs SSN or PTIN |

||||||

|

|

|

|

|

|

|

|

|

PreparerÕs name, address and telephone number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CODE NUMBER |

FOR OFFICE USE ONLY |

||||||

MARYLAND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 510 |

INCOME TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

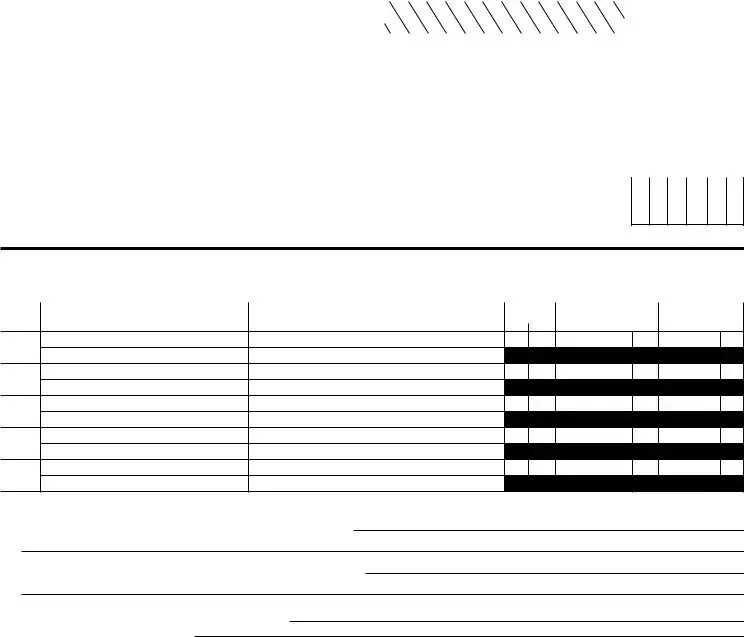

COMPUTATION OF APPORTIONMENT FACTOR |

|

|

|

|

|

|

|

|

Column 1 |

|

|

|

|

|

|

|

|

|

Column 2 |

|

|

|

|

|

|

|

Column 3 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

TOTALS |

|

DECIMAL FACTOR |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(Applies only to multistate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

WITHIN |

|

|

|

|

|

WITHIN AND |

|

|

|

Column 1 Ö Column 2 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NOTE: Special apportionment formulas are required for rental/leasing, transportation and |

|

|

|

|

|

|

MARYLAND |

|

|

|

|

|

|

|

|

WITHOUT |

( rounded to six places ) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

manufacturing companies. Multistate manufacturers with more than 25 employees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARYLAND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

must complete Form 500MC. See Instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1A. Receipts |

a. Gross receipts or sales less returns and allowances . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b. Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

c. Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

d. Gross rents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

e. Gross royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

f. Capital gain net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

g. Other income (Attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1B. Receipts |

h. Total receipts (Add lines 1A(a) through 1A(g), for Columns 1 and 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(Enter the same factor shown on line 1A, Column 3 Ð Disregard this line if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. Property |

special apportionment formula used.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

a. Inventory |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b. Machinery and equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

c. Buildings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

d. Land |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

e. Other tangible assets (Attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

f. Rent expense capitalized (multiplied by eight) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. Payroll |

g. Total property (Add lines 2a through 2f, for Columns 1 and 2) . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

a. Compensation of officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b. Other salaries and wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

c. Total payroll (Add lines 3a and 3b, for Columns 1 and 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4. Total of factors (Add entries in Column 3) |

. |

. |

|

. |

. |

. |

. |

|

. |

. |

|

. |

. |

. |

. . |

|

. |

. |

. |

|

. |

. |

|

. |

. |

. |

. |

|

. |

. |

. |

. |

. |

. |

|

. |

. |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5.Maryland apportionment factor (Divide line 4 by four for

PARTNERS’, SHAREHOLDERS’ OR MEMBERS’ INFORMATION (Attach continuing schedule in same format if there are more than five partners, shareholders or members)

Name and social security number or federal |

Address |

Check here |

Distributive or |

Distributive or |

employer identification number |

|

if Maryland: |

pro rata share of income |

pro rata share of tax paid |

|

Non- |

(See Instructions) |

(See Instructions) |

|

|

|

Resident resident |

|

|

1

2

3

4

5

ADDITIONAL INFORMATION REQUIRED (Attach a separate schedule if more space is necessary)

1.Address of principal place of business (if other than indicated on page 1):

2.Address at which tax records are located (if other than indicated on page 1):

3.Telephone number of

4.State of organization or incorporation:

5.Has the Internal Revenue Service made adjustments (for a tax year in which a Maryland return was required) that were not previously reported

to the Maryland Revenue Administration Division? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ☐ Yes |

☐ No |

|

If Òyes,Ó indicate tax year(s) here: |

|

and submit an amended return(s) together with a copy of the IRS adjustment report(s) |

|

under separate cover. |

|

|

|

6. Did the |

☐ No |

||

COM/RAD 069 |

File Breakdown

| Fact | Detail |

|---|---|

| Form Name | Maryland Form Pass-Through Entity 510 Income Tax Return |

| Year | 2002 (Or applicable fiscal year) |

| Entity Types | S Corporation, Partnership, Limited Liability Company, Business Trust |

| Special Instructions for | Multistate pass-through entities; Manufacturing entities with more than 25 employees must complete Form 500MC |

| Apportionment Factor Calculation | Required for multistate pass-through entities; involves gross receipts, property, and payroll |

| Nonresident Taxation | Details on calculation and payment for nonresident partners, shareholders, or members |

| Governing Law | Maryland State Tax laws and regulations |

| Submission Detail | Payable to: Comptroller of Maryland; Mailing Address: Revenue Administration Division, Annapolis, Maryland 21411-0001 |

Steps to Filling Out Maryland Frorm 510

Filling out the Maryland Form 510 for your pass-through entity is a critical annual task to ensure proper income tax reporting and compliance with state law. This form captures vital details about the income, allocations, and tax responsibilities of the entity. Carefully following the step-by-step instructions will help streamline the process, reduce errors, and potentially avoid unnecessary complications or delays with the state tax authority.

- Begin by ensuring you're using the correct form for the tax year in question, as forms can update.

- Enter the name of the pass-through entity at the top of the form.

- Provide the Federal Employer Identification Number (FEIN) in the designated space.

- Check the appropriate box to indicate the type of entity (S Corporation, Partnership, Limited Liability Company, or Business Trust).

- If there has been a change in name or address, or if other specified conditions apply (inactive entity, amended return, etc.), check the corresponding box.

- Fill in the date of organization or incorporation and the business activity code number, both essential for record-keeping and identification.

- List the number of partners, shareholders, or members as requested in sections 1a through 1d, ensuring to distinguish between Maryland residents, nonresidents, and others.

- Record the total distributive or pro rata income as per your federal return in the provided space for line 2.

- If applicable, complete the allocation of income section. This includes:

- Entering non-Maryland income for entities using separate accounting on line 3a.

- Calculating the Maryland apportionment factor on line 3b using the computation worksheet on page 2 of the instructions.

- For multi-state pass-through entities with nonresident members, fill out lines 4 through 9 to determine the distributive share allocable to Maryland and the nonresident tax due.

- Enter the details of estimated and tentative payments made with Forms 510D and 510E on lines 10a and 10b, then sum these on line 10c.

- If the tax due on line 9 exceeds the total payments on line 10c, calculate and enter the balance due on line 11.

- Assess any applicable interest and/or penalty, recording this amount on line 12.

- Sum lines 11 and 12 to determine the total balance due, and ensure this amount is paid in full with the return.

- Lastly, the form must be signed and dated by an authorized partner, officer, or member. If a paid preparer was used, their information should also be included.

- Make a check payable to the COMPTROLLER OF MARYLAND, ensuring to write the federal employer identification number on the check, and mail the form and payment to the indicated address.

Upon submission, it's important to keep a copy of the form and any supporting documentation for your records. Timely and accurate completion helps maintain the good standing of the pass-through entity and ensures compliance with Maryland's tax obligations.

More About Maryland Frorm 510

What is the Maryland Form 510?

The Maryland Form 510 is an income tax return specifically designed for pass-through entities such as S Corporations, Partnerships, Limited Liability Companies (LLCs), and Business Trusts. This form allows these entities to report their income, deductions, and tax liabilities to the state of Maryland.

Who needs to file the Maryland Form 510?

Any pass-through entity that operates in Maryland or receives income from Maryland sources is required to file the Maryland Form 510. This applies whether the entity is physically located in Maryland or is an out-of-state entity doing business in Maryland.

What information is required on Form 510?

To complete Form 510, an entity will need to provide:

- Their Federal Employer Identification Number (FEIN)

- The date of organization or incorporation

- A detailed breakdown of partners, shareholders, or members, including the number of residents and non-residents

- Total distributive or pro rata income as per their federal return

- Information on income allocation for multi-state entities

- Details on nonresident tax due, payments made, and any balance owing

How is income allocated for multi-state entities on Form 510?

Income for multi-state entities is allocated using either separate accounting or the apportionment method based on Maryland’s apportionment factor, which is calculated from the entity's gross receipts, property, and payroll expenses in Maryland versus total gross receipts, property, and payroll expenses.

What are the filing deadlines for Form 510?

Form 510 must be filed by the 15th day of the fourth month following the close of the tax year for the entity. For most entities operating on a calendar year, the deadline is April 15th. Entities with a different fiscal year will have varying deadlines accordingly.

What happens if an entity needs to amend a previously filed Form 510?

If an entity discovers errors or omissions in a previously filed Form 510, it must file an amended return. This involves checking the “AMENDED RETURN” box on the Form 510 and clearly explaining the changes made from the original submission. Documentation supporting the amendments should be included with the filed form.

Can Form 510 be filed electronically?

Yes, Maryland encourages the electronic filing of Form 510 to streamline the tax filing process and facilitate quicker processing. Electronic filing options are available through approved software providers and the Maryland Comptroller’s website.

What penalties can be incurred for failing to file Form 510?

Entities that fail to file Form 510 by the due date may face penalties including interest charges on unpaid taxes and additional fines based on the amount of tax owed and the length of the filing delay. Prompt filing, even if the entity cannot pay the full tax due, can help minimize these penalties.

Common mistakes

Forgetting to use black or blue ink when filling out the form, which is a small but crucial detail ensuring the form's legibility and professionalism.

Not checking the appropriate box under TYPE OF ENTITY, leading to confusion about the entity's status and potentially affecting how tax information is processed.

Omitting or incorrectly entering the Federal Employer Identification Number (FEIN), a critical piece of information that ties the form to the correct entity within tax records.

Skipping the section that asks for updates on the name or address changes, potentially causing important correspondence to be sent to an outdated address.

Filling in the number of partners, shareholders, or members inaccurately in section 1, which impacts the allocation and distribution calculations of income or loss.

Missing the allocation of income section, namely for multistate entities, by not accurately reporting Non-Maryland income or the Maryland apportionment factor, leading to incorrect state income calculations.

Incorrectly calculating the distributive or pro rata share allocable to Maryland, which is essential for determining the correct amount of state tax due.

Failing to document estimated pass-through entity tax paid, underpayments, or overlooking the payments section entirely, resulting in inaccuracies in the tax due or refund.

Overlooking the need to sign the form or obtain the preparer’s signature and contact information, a mandatory step that validates the form's authenticity and accuracy.

Each of these mistakes can lead to delays in processing, inaccurate tax obligations, or missed opportunities for compliance. Therefore, attention to detail and thorough review before submission are critical.

Documents used along the form

When preparing a Maryland Form 510 for pass-through entities, certain additional forms and documents may often be necessary to ensure a comprehensive and fully compliant tax return submission. The following list outlines some of these supporting documents, which vary in purpose from detailing income allocations to reporting specific types of income or state-specific adjustments.

- Form 500MC - This form is for multistate corporations, including manufacturing entities with more than 25 employees, to compute a special apportionment factor. It’s used to determine how much of the entity's income is subject to Maryland state tax.

- Form 510C - The Composite Pass-Through Entity Income Tax Return is for reporting and paying tax on behalf of nonresident members. It simplifies filing for pass-through entities with numerous nonresident members.

- Form 510D - Used for making Declaration of Estimated Pass-Through Entity Nonresident Income Tax, this form helps entities to pay their estimated nonresident taxes in advance.

- Form 510E - This Application for Extension to File Pass-Through Entity Income Tax Return gives pass-through entities additional time to file their Maryland Form 510, if needed.

- Form 510 Schedule K-1 - Issued to each member, shareholder, or partner, this schedule reports their share of the pass-through entity's income, deductions, and credits.

- Form MW506NRS - Maryland Return of Income Tax Withholding for Nonresident Sale of Real Property is required for entities involved in real estate transactions and needing to report withholding for nonresident members.

- Schedule K - This schedule is used to report the total income, deductions, and tax credits of the pass-through entity.

- Schedule O - For pass-through entities with other adjustments to income not captured elsewhere on the return or schedules, Schedule O provides the necessary space to explain and detail these adjustments.

- Attachment for Special Apportionment - If an entity uses a special apportionment formula due to its industry or specific income characteristics, a detailed explanation and calculation of this apportionment must be attached.

Careful preparation and submission of these documents, alongside the Maryland Form 510, ensure that the state's reporting requirements are fully met by the pass-through entity. These forms and schedules provide the necessary means to detail and break down various aspects of income, taxation, and entity-specific information, making for a comprehensive approach to state income tax compliance.

Similar forms

The Maryland Form 510 form is similar to several federal tax documents, tailored to meet specific state tax requirements for pass-through entities such as S Corporations, partnerships, limited liability companies, and business trusts. These entities report income, deductions, and credits through the personal tax returns of their members or partners. By examining similar federal forms, one can grasp the purpose and necessity of Maryland Form 510 in the state's tax structure.

Form 1065 (U.S. Return of Partnership Income) is a crucial document for partnerships at the federal level. Much like the Maryland Form 510, Form 1065 is designed to report the income, gains, losses, deductions, and credits from the operations of a partnership. Both forms ensure that the financial activities of the pass-through entity are transparent to the taxation authorities, thereby allocating the tax responsibility to the individual members based on their share of the entity's income. The emphasis on distributive share reporting is a cornerstone shared between Form 510 and Form 1065, albeit within their respective tax jurisdictions.

Form 1120S (U.S. Income Tax Return for an S Corporation) serves a similar purpose at the federal level for S corporations as the Maryland Form 510 does at the state level. Form 1120S is used by S corporations to report the corporation's income, gains, losses, deductions, credits, and other information. Both forms share a commonality in ensuring that the income passes through to the shareholders or members, who then report the income on their individual tax returns. The requirement to report the number of shareholders, along with their shares of the corporation's income and losses, demonstrates how both forms play a pivotal role in the taxation of pass-through entities, facilitating the flow-through of income to be taxed at the individual level.

Dos and Don'ts

When completing the Maryland Form 510, attention to detail is crucial for ensuring the accuracy and compliance of your pass-through entity's income tax return. Here are five essential things you should do, along with five things you should avoid, to help guide you through the process effectively:

-

Do:

- Ensure that you print in black or blue ink as required to maintain the readability of your document.

- Verify the Federal Employer Identification Number (FEIN) is entered correctly to avoid processing delays or issues with your return.

- Accurately report the total number of partners, shareholders, or members, including the breakdown by residency status, to ensure proper tax consideration.

- Use the correct business activity code, a six-digit number that accurately represents the primary business activity, to comply with tax regulations.

- Check the appropriate boxes regarding the type of entity and any changes in name or address to maintain accurate records.

-

Don't:

- Leave any required fields blank. Incomplete forms may result in processing delays or penalties.

- Misreport income allocation between Maryland and non-Maryland income, as this can lead to incorrect tax calculations.

- Forget to sign and date the form. An unsigned return is considered invalid and will not be processed.

- Overlook attaching any required schedules or documentation that supports your return's entries, such as a computation worksheet for the Maryland apportionment factor.

- Disregard the guidance for specific types of entities, such as manufacturing entities or multistate pass-through entities, which may have additional requirements or forms to complete.

Misconceptions

There are several common misconceptions about the Maryland Form 510 that businesses and tax professionals should be aware of. Let's clarify these misunderstandings to ensure accurate and compliant tax filings for pass-through entities in Maryland.

- Misconception 1: Form 510 is only for S Corporations.

- Misconception 2: All income reported on Form 510 is subject to Maryland tax.

- Misconception 3: The number of nonresident members does not affect filing requirements.

- Misconception 4: Estimated tax payments and withholding payments are the same.

- Misconception 5: Only the total balance due is reported on the form.

This is incorrect. While S Corporations do use this form, it is also required for partnerships, limited liability companies (LLCs), and business trusts that are recognized as pass-through entities under Maryland tax laws. Each entity type must accurately indicate its classification in the designated section on the form.

Not all income is treated equally. The form allows for separate accounting for non-Maryland income and uses an apportionment method for multistate entities to determine the income allocable to Maryland. Understanding these distinctions can impact the taxable income reported to the state.

The filing requirements can indeed vary based on the composition of the entity's members. For instance, if there are no individual nonresident members, certain sections of the form are not required to be completed. This detail highlights the importance of accurate member categorization.

These are two distinct types of payments. The form delineates between estimated tax payments made with Form 510D and tentative tax payments made with Form 510E. Entities must accurately record and report these payments in their designated sections to ensure proper credit towards their tax liability.

While the total balance due, including any interest and penalties, is essential, Form 510 requires a detailed breakdown of the components leading to this total. Reporting begins with the distributive share and nonresident tax calculations before deducting payments to arrive at the balance due. This process ensures transparency and accuracy in tax computations and payments.

Understanding the specific requirements and nuances of Maryland Form 510 is vital for pass-through entities to comply with state tax obligations accurately. Dispelling these misconceptions ensures a smoother filing process and helps avoid common pitfalls.

Key takeaways

Filling out the Maryland Form 510, the income tax return for pass-through entities, is critical for ensuring compliance with state tax obligations. Here are ten key takeaways to help guide individuals and entities through the process:

- The form is designed for pass-through entities such as S Corporations, Partnerships, Limited Liability Companies (LLCs), and Business Trusts that operate in Maryland.

- It is important to provide the entity’s name, Federal Employer Identification Number (FEIN), and contact details accurately at the top of the form.

- The form requires specification of the type of entity to determine the applicable tax rules and rates.

- Any changes in the entity's name or address, as well as the entity's status (e.g., inactive, amended return, first filing, or final return) should be indicated in the designated check boxes.

- Entity’s business activity code, date of organization or incorporation, and the number of partners, shareholders, or members need to be filled out carefully to reflect the current operational status.

- Details of the entity's income according to the federal return are crucial for calculating the state tax responsibility. This includes total distributive or pro rata income and any adjustments for non-Maryland income or allocations.

- The form requires an apportionment calculation for entities operating in multiple states, to determine the income attributable to Maryland.

- Entities with nonresident members must calculate and report nonresident tax due, taking into account distributions and applicable limitations.

- Payments made throughout the year, including estimated tax payments and any balance due, must be reported accurately to avoid penalties.

- The signature and affirmation section at the end of the form is a declaration under penalty of perjury, emphasizing the importance of accuracy and completeness in the information provided.

By paying attention to these key points, entities can more effectively navigate the process of completing the Maryland Form 510, ensuring compliance and avoiding common pitfalls.

Common PDF Templates

Maryland 502 Form - It addresses local taxation issues for nonresidents working in Maryland from specified jurisdictions.

Do Employers Pay Unemployment - Procedure for updating employer account information, including address changes.

University of Maryland Admission Requirements - Through this form, individuals are empowered to take an active role in their mental health treatment process.